Top User Research Platforms Every Product Team Should Know

In today’s world of product development, UX design, and marketing, user research isn’t a luxury; it’s a requirement.

Teams that skip research risk building features no one needs, while those that invest in it can uncover what truly drives adoption, loyalty, and growth.

User research platforms make this possible by giving teams the tools to gather insights directly from real users.

Whether the goal is improving a signup flow, identifying why users abandon their carts, or validating a new product concept, these platforms provide the data needed to make decisions with confidence.

There’s no single best method, because teams often create a user research methods sketch that blends surveys, usability testing, behavioral analytics, heatmaps, or in-depth interviews.

Some research tools reveal the “what”, others explain the “why”. Survey platforms like Polling.com do both, offering scalable reach and actionable insights while staying simple enough for any team to adopt quickly.

What Are User Research Platforms?

A user research platform is any tool that helps teams understand how people actually interact with their product, what motivates them, and where friction appears.

These platforms replace guesswork with real-world evidence, guiding product, design, and marketing teams toward decisions that increase user experience and business outcomes.

Different platforms approach research from different angles.

Some capture direct feedback, others observe real-time behavior, while others analyze data at scale. Together, they give teams a 360-degree view of the customer journey.

The main categories include:

- Survey platforms (e.g., Polling.com): Quick and scalable way to measure satisfaction, motivations, and pain points. Ideal for NPS, onboarding feedback, and product validation.

- Usability testing tools (e.g., Maze, Lookback): Allow teams to watch how users complete tasks, uncovering navigation issues, confusing flows, or drop-off points.

- Heatmaps & session recordings (e.g., Hotjar, FullStory): Visualize user behavior by showing clicks, scroll depth, and rage quits, perfect for optimizing key pages.

- Interview & diary study tools (e.g., dscout, User Interviews): Provide deeper qualitative insights into user attitudes, emotions, and decision-making.

- Analytics & journey platforms (e.g., Mixpanel, Amplitude): Capture large-scale behavioral data across events and funnels to track retention, conversions, and growth trends.

By combining these categories, teams can balance breadth (large-scale survey and analytics data) with depth (qualitative interviews and usability tests).

This layered approach makes user research platforms essential for creating products that are not only functional but also enjoyable to use.

5 Common Types of User Research Platforms

User research isn’t one-size-fits-all, as different tools answer different website user experience questions. Some uncover why users behave a certain way, while others show what they do at scale.

By mixing methods, teams can capture both the numbers that prove patterns and the stories that explain them.

Let’s break down the most common types of user research tools, along with real-world use cases and examples.

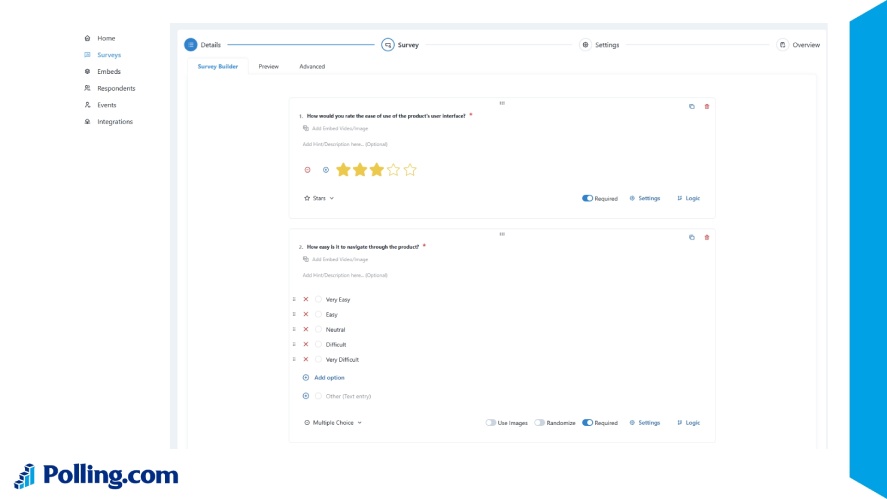

1. Surveys and Polling Platforms

Among the many types of surveys, this method is one of the most direct ways to understand your users.

Instead of guessing, you ask them about their motivations, frustrations, and preferences, and then scale that feedback across hundreds or even thousands of responses.

This makes surveys especially powerful for collecting quantitative data that can guide product and marketing decisions.

- Use cases: Measuring NPS, running pre/post-launch feedback, validating product-market fit, or pinpointing churn reasons.

- Why they’re effective: They provide statistically significant data, allow for trend tracking over time, and make it easy to compare results across segments.

- Examples: Polling.com, SurveyMonkey, Typeform.

Why Surveys Stand Out

- Scalable and fast, reach large groups quickly

- Quantitative insights that reveal patterns across users

- Perfect for onboarding feedback, customer satisfaction, and market validation

Among popular survey platforms, Polling.com shines thanks to its mobile-first design and advanced analytics (even on its free tier), making it a go-to choice for modern teams.

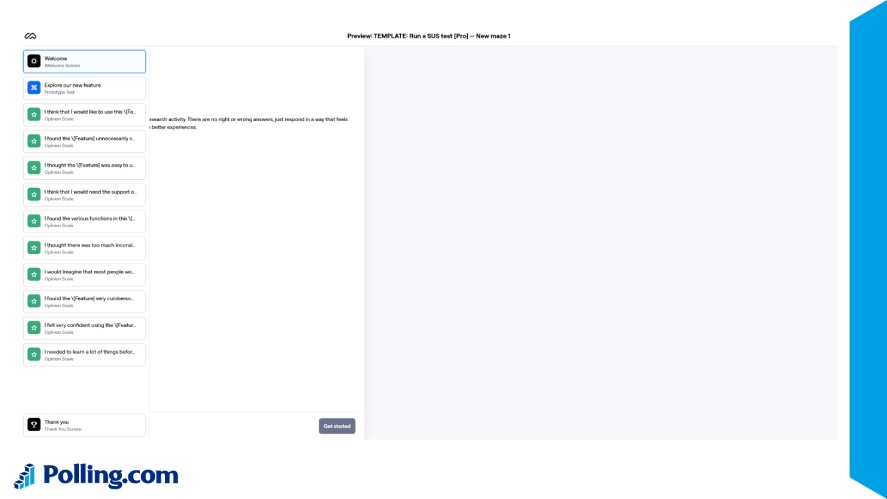

2. Usability Testing Tools

Usability analysis tools, often used in quantitative usability testing, allow you to watch how real users interact with your product, prototype, or feature.

By observing their actions, teams can uncover points of friction that might not show up in survey data.

These tools are especially valuable in the design and pre-launch stages, where small usability issues can cause major adoption problems later.

- Use cases: Running A/B tests, identifying onboarding flow barriers, testing navigation clarity.

- Examples: Maze, UserTesting, PlaybookUX.

Usability testing delivers direct evidence of whether your product is intuitive, and gives you the insights needed to refine before scaling.

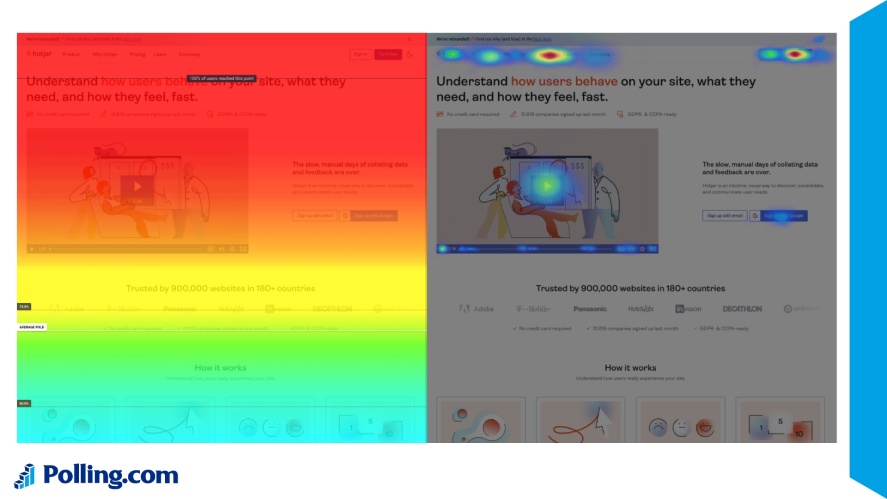

3. Session Recording & Heatmap Tools

Session recording and heatmap platforms capture how users behave on a webpage or app without requiring direct input.

By visualizing where users click, scroll, and drop off, these tools highlight design elements that work and those that cause confusion.

- Use cases: Detecting drop-off points, improving conversion funnels, optimizing page layouts.

- Examples: Hotjar, FullStory, Smartlook.

Heatmaps and recordings help you see patterns in real time, making them indispensable for website UX optimization and troubleshooting.

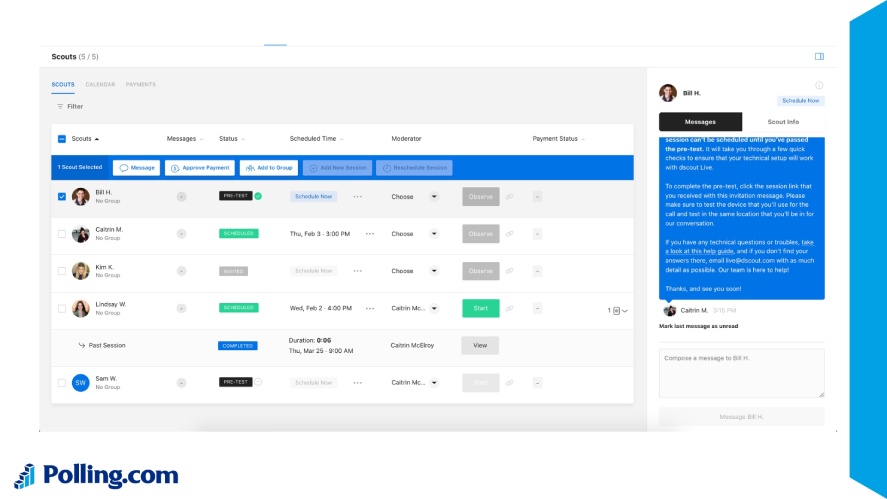

4. Interview and Diary Study Platforms

Sometimes numbers don’t tell the full story, and that’s where interviews and diary studies come in.

These tools capture qualitative insights by letting you talk directly with users or track their behaviors over time.

Teams gain context about motivations, emotions, and decision-making that’s hard to capture in structured surveys.

- Use cases: Exploring user behavior in depth, understanding emotional responses, long-term engagement tracking.

- Examples: dscout, User Interviews, Lookback.

These UX research platforms bring human voices into the data mix, giving you the nuance needed to design more empathetic and user-centered products.

5. Product & Behavioral Analytics Platforms

Analytics platforms track what users do inside your product: every click, event, and funnel stage.

This data reveals how people engage with features, where they drop off, and which behaviors drive long-term retention.

Unlike surveys or interviews, analytics provide an objective, large-scale view of actual usage.

- Use cases: Measuring engagement, monitoring retention, analyzing conversion funnels.

- Examples: Mixpanel, Heap, Amplitude.

For product managers and growth teams, these user research software are essential for spotting trends, testing hypotheses, and aligning business goals with real user behavior.

Why Surveys (and Polling.com) Are Still the Backbone of User Research

Interviews, usability testing, and session replays all uncover valuable insights, but they tend to work with small samples.

Surveys, on the other hand, are also the clearest example of how to collect customer feedback at scale, moving beyond anecdotes to statistically reliable data from hundreds or thousands of users.

This combination of breadth and measurability makes surveys the foundation of most user research strategies.

Surveys are also uniquely suited to turning qualitative observations into hard numbers.

If a handful of testers struggle with onboarding, a survey can confirm whether that friction is widespread or just an isolated case.

Over time, repeating these surveys not only establishes benchmarks like NPS or satisfaction trends but also highlights the benefits of customer feedback in tracking progress and improvements with confidence.

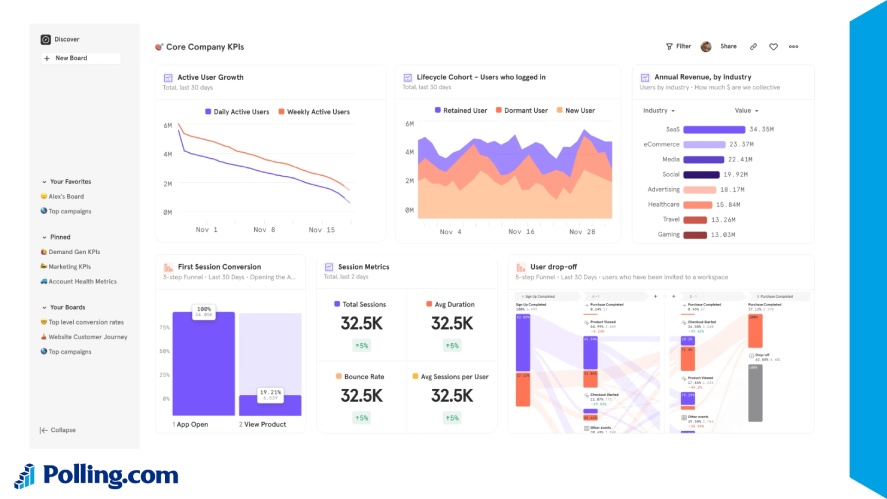

What sets Polling.com apart is how easy it makes this process.

Teams can launch surveys quickly, analyze responses in real time, and tap into ready-made templates for use cases like churn analysis, UX feedback, or product-market fit validation.

With mobile optimization and seamless integrations into CRMs and product feedback tools, Polling.com ensures research fits naturally into existing workflows.

In short, while newer tools add depth to user research, surveys, and especially Polling.com, continue to provide the speed, scalability, and reliability that product teams rely on to make informed decisions.

Comparison: Best User Research Platforms in 2025

Different platforms serve different research needs. Here’s a quick comparison of the leading tools and their strengths and limitations in 2025:

| Platform | Type | Strengths | Limitations |

| Polling.com | Survey/Quantitative | Fast insights, AI analytics, free tier | Not for in-depth screen recordings |

| Maze | Usability Testing | Task-based UX tests, prototype feedback | Less useful for surveys |

| Hotjar | Session Recording | Heatmaps, rage clicks, scroll tracking | No direct feedback from users |

| dscout | Diary Studies | Deep qualitative behavior insights | Expensive, time-intensive |

| Mixpanel | Behavioral Analytics | Funnels, retention, cohort analysis | Requires setup + dev resources |

This comparison shows that while each customer feedback software has its niche, surveys and especially Polling.com provide the most scalable and statistically reliable way to collect actionable insights, making them the go-to foundation for most product teams.

Common Use Cases for User Research Platforms

Teams don’t use research tools just to collect data; they use them to solve real problems.

Whether it’s fixing a confusing signup flow, checking if a new idea makes sense, or figuring out why people leave, these platforms help connect user feedback directly to product decisions.

Improve Product Onboarding

Onboarding is often where users decide if they’ll stick around. Watching replays shows where people get stuck, and short surveys reveal why they drop off.

With that insight, teams can cut friction and make activation smoother.

Validate New Feature Concepts

Before spending weeks building, it’s smart to test. Prototype tests show how users interact, while quick surveys confirm if the feature solves a real pain point.

This saves time and avoids launching features no one wants.

Measure Customer Satisfaction and NPS

Customer sentiment changes over time. Running recurring NPS or satisfaction surveys makes it easy to see if your product is improving or slipping.

Tracking trends helps spot problems early before churn rises.

Reduce Churn

Churn doesn’t happen by accident; there are usually signals.

Exit surveys tell you why people leave, and heatmaps highlight points of frustration. Acting on both helps reduce drop-offs and increase retention.

Test Navigation and Information Architecture

If users can’t find what they need, they won’t stay long.

Usability tests and click maps show where navigation is confusing, while follow-up surveys explain the “why”.

Together, they help make products easier to explore.

Which User Research Platform Is Best for Accuracy?

When it comes to accuracy in user research, no single tool covers everything. The right choice depends on the type of data you need.

Polling.com is often the most reliable option for accuracy because its AI-powered analytics help clean messy data, remove bias, and deliver statistically valid insights in real time.

If you’re focused on task-specific behavior, Maze shines for measuring whether users can complete flows or prototypes, but it doesn’t capture direct sentiment.

Hotjar, on the other hand, is great for spotting passive behaviors like rage clicks or scroll depth but doesn’t tell you why users act that way.

For overall validity and repeatability, surveys remain the gold standard.

They’re scalable, quantifiable, and when combined with usability or UX analytics tools, they give teams both the “what” and the “why” behind user behavior.

How to Choose the Right User Research Platform

With so many UX research tools available, the best platform for your team depends on your goals.

Start by defining what kind of insights you need:

- Quantitative data: Like NPS or churn reasons

- Qualitative feedback: Such as emotional reactions or usability struggles

- Behavioral tracking: How users actually interact with your product

For most teams, surveys are the natural starting point. Platforms like Polling.com provide scalable insights quickly, giving you a reliable baseline of user sentiment.

Once you’ve established those metrics, you can layer in usability testing platforms to uncover friction in specific flows, or analytics platforms to measure long-term engagement.

Budget, team size, and time constraints also play a big role.

A startup may only need a single, all-in-one survey tool, while larger product teams often combine multiple platforms for a full research stack.

The key is to choose tools that complement each other rather than overlap unnecessarily.

Conclusion

User research comes in many forms: from surveys, usability tests, heatmaps, interviews, and analytics, and each addressing different parts of the user journey.

Surveys deliver statistical confidence, usability testing reveals friction, analytics track behavior at scale, and interviews uncover motivations.

Surveys remain the foundation of user research, delivering reliable and repeatable insights that validate ideas, measure satisfaction, and shape product strategy.

With AI-driven survey data analysis, quick deployment, and real-time results, platforms like Polling.com make surveys even more impactful.

The strongest results come from layering methods: start with surveys for patterns, add usability tests and interviews for depth, and confirm impact with analytics.

By combining these approaches, teams build products that align with real user needs.

Get started with Polling.com today — build better experiences by knowing your users.