30 Product Survey Questions for Gathering Powerful Customer Feedback

In today’s competitive landscape, a product survey isn’t just a formality; it’s a direct line to understanding your market and ensuring your product truly meets customer needs.

A well-designed set of product survey questions can bridge the gap between guesswork and product-market fit, giving you the confidence to make decisions backed by data.

Surveys reveal how well your product aligns with the expectations, preferences, and challenges of your audience. They turn vague assumptions into measurable insights.

This is why product researchers and exploratory research marketing teams rely on them as foundational tools in both market survey of a product studies and product analysis reports.

Customer voice remains the most reliable source of innovation ideas. While trend reports and competitor analysis have their place, nothing beats direct product feedback survey responses from the people who actually use your product.

These insights often highlight hidden friction points, overlooked features, or untapped opportunities for product improvement.

Beyond guiding development, product survey data fuels multiple departments.

Marketing teams use it to refine messaging, sales teams leverage it to address objections, and support teams use it to preempt common issues.

Whether you distribute surveys through top survey apps like Polling.com, paid surveys, or even free survey tools for nonprofits, the collected insights become a shared resource across the organization.

The Psychology Behind Good Survey Questions

Crafting effective survey questions is as much a psychological exercise as it is a technical one.

The way a question is worded can dramatically impact how honestly and completely respondents answer. Even the best market analysis example can be undermined if the survey questions are unclear, overly complex, or subtly biased.

One major pitfall to avoid is cognitive overload. It’s when a question tries to cover too many concepts at once or uses jargon unfamiliar to your audience.

Overwhelmed respondents are more likely to give rushed, incomplete, or even random answers, weakening your product analysis results.

Then there’s the framing effect, a cognitive bias where the way information is presented can influence the answer.

For example, asking “How satisfied are you with our improved checkout process?” assumes the process has improved, which might nudge answers in a more positive direction.

On the other hand, a neutral phrasing like “How would you rate your experience with our checkout process?” encourages a more balanced response.

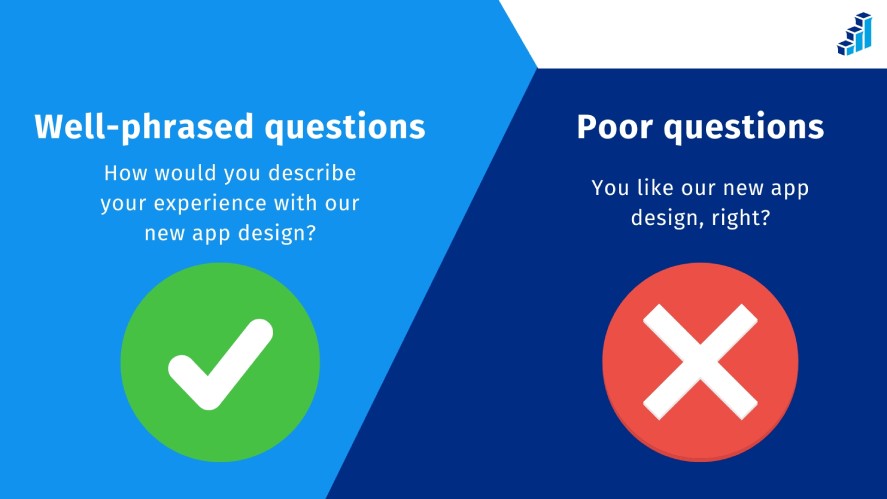

Consider the difference between poor and well-phrased questions:

- Poor: “You like our new app design, right?”

- Better: “How would you describe your experience with our new app design?”

The second version is open-ended, non-leading, and invites richer insights. It’s exactly what a product feedback survey is meant to achieve.

By consciously shaping questions to be neutral, clear, and concise, you set the stage for more accurate data and better-informed product improvement decisions.

Anatomy of an Effective Product Survey

Designing a powerful product survey starts long before you write your first question.

The most effective surveys are built on a foundation of clear goals, thoughtful question formats, and accessibility for every type of respondent.

Defining Clear Survey Goals Before Writing Questions

Before crafting your survey, you need to know exactly what you want to achieve.

Are you trying to improve customer retention, validate a potential new feature, or measure customer satisfaction with an NPS score? Mapping each question to a specific objective ensures your survey stays focused and relevant.

This goal-driven approach prevents unnecessary or repetitive questions and keeps respondents engaged from start to finish.

Choosing the Right Question Types

The type of questions you ask directly affects the depth and clarity of the responses you receive.

Multiple-choice questions are great for collecting quick, structured data, while open-ended questions give customers the freedom to share detailed thoughts in their own words.

Likert scales help measure attitudes or agreement levels, and simple rating scales are useful for quick impressions of satisfaction or quality.

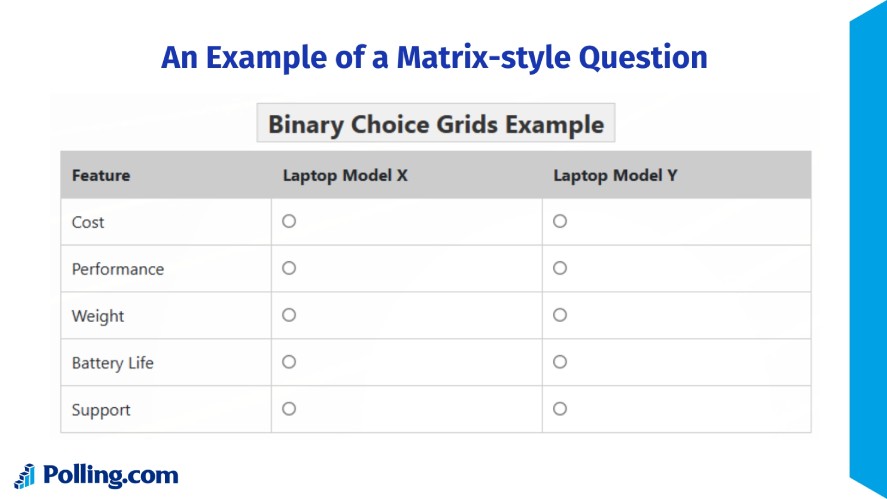

For more complex evaluations, matrix-style questions can condense multiple related queries into one compact format. Just be careful to avoid overwhelming respondents with too many rows or columns.

Keeping Surveys Mobile-Friendly

With more users completing surveys on their phones than ever before, mobile optimization is no longer optional.

A poorly formatted survey can lead to high abandonment rates, especially if participants have to pinch, zoom, or scroll excessively.

Keep customer feedback questions short, use responsive layouts, and ensure answer options are easy to tap.

Mobile-friendly formats not only improve the user experience but also give you a broader and more representative set of responses, especially from on-the-go customers.

Core Categories of Product Survey Questions and Examples

Great product survey questions go beyond simply asking whether customers like your product; they explore satisfaction, uncover opportunities, and reveal the hidden factors behind purchase and retention.

Here are the core categories to gather targeted insights that directly inform product development, marketing, and customer experience strategies.

Customer Satisfaction and Loyalty Questions

Customer satisfaction questions often use rating scales to measure how happy people are with your product and how likely they are to stay.

For example, you might ask, “On a scale of 1–10, how satisfied are you with [Product]?”.

These quick, quantifiable responses can reveal patterns that point to potential retention risks. If satisfaction dips in certain segments, you’ll know where to focus improvements before customers churn.

Product Feature Evaluation Questions

When you want to measure the usefulness of a specific feature, targeted evaluation questions are key.

Asking users how often they use a feature or how much value it adds can help you identify which tools are essential and which may be ignored.

This is also how you detect feature bloat, where unnecessary or low-impact features clutter the product. Streamlining based on feedback not only simplifies the experience but can also boost perceived value.

Purchase Decision and Motivation Questions

Understanding why customers choose your product in the first place gives you a competitive edge.

Questions like, “What was the biggest reason you chose [Product] over competitors?” shed light on the triggers behind an initial purchase.

Whether it’s price, unique features, or brand reputation, this information can refine both marketing messages and sales strategies.

Product Improvement and Innovation Questions

Some of the best ideas come straight from your customers.

Asking “If you could add one feature to [Product], what would it be?” gives them a voice in your product’s evolution and highlights gaps you may not see internally.

These responses can fuel your innovation pipeline and ensure your roadmap reflects real-world needs.

Pricing Perception Questions

How your customers perceive pricing says a lot about the value they see in your product.

Questions about fairness or value for money can reveal whether your pricing aligns with expectations.

The answers can guide strategic adjustments, helping you fine-tune upsells, bundles, and promotions without eroding trust.

Customer Support and Experience Questions

Every support interaction leaves an impression, whether it’s good or bad.

Asking targeted follow-up questions after a support request helps you gauge resolution quality, response speed, and overall customer satisfaction.

Strong support can turn casual buyers into loyal fans, while poor experiences can quickly undo even the best marketing efforts.

30 Example Product Survey Questions You Can Use Immediately

Here’s a list of 30 product survey questions grouped under the categories with the purpose, ideal target audience, and recommended follow-up questions for each.

Customer Satisfaction and Loyalty Questions

- On a scale of 1–10, how satisfied are you with [Product]?

- Purpose: Measure overall satisfaction.

- Target Audience: All active customers.

- Follow-up: What’s the main reason for your rating?

- How likely are you to recommend [Product] to a friend or colleague?

- Purpose: Calculate Net Promoter Score (NPS).

- Target Audience: All customers after at least one use.

- Follow-up: What could we do to improve your recommendation score?

- What’s the one thing you love most about [Product]?

- Purpose: Identify core strengths to highlight in marketing.

- Target Audience: Long-term and repeat customers.

- Follow-up: When did you first notice this benefit?

- What’s the one thing you’d change about [Product]?

- Purpose: Pinpoint weaknesses that impact retention.

- Target Audience: Mixed audience of satisfied and unsatisfied users.

- Follow-up: How would you like to see it improved?

- Have you considered switching to a competitor in the last 6 months?

- Purpose: Identify potential churn risk.

- Target Audience: Current customers.

- Follow-up: What was the main reason you considered switching?

Product Feature Evaluation Questions

- Which feature of [Product] do you use most often?

- Purpose: Find your most valued features.

- Target Audience: Frequent or long-term users.

- Follow-up: Why is this feature important to you?

- Which feature of [Product] do you use the least?

- Purpose: Detect underused or redundant features.

- Target Audience: All active users.

- Follow-up: What would make you use this feature more?

- How easy is it to use [specific feature]?

- Purpose: Evaluate usability and UX design.

- Target Audience: New and experienced users of the feature.

- Follow-up: What specific improvements would help?

- If we removed [specific feature], how would that affect your experience?

- Purpose: Test for feature bloat vs. necessity.

- Target Audience: Power users and beta testers.

- Follow-up: What would you want instead?

- How would you rate the performance of [specific feature]?

- Purpose: Measure functionality satisfaction.

- Target Audience: Active users.

- Follow-up: What issues have you experienced?

Purchase Decision and Motivation Questions

- What was the biggest reason you chose [Product] over competitors?

- Purpose: Identify your competitive advantage.

- Target Audience: New customers.

- Follow-up: Which other products did you consider?

- Where did you first hear about [Product]?

- Purpose: Track most effective marketing channels.

- Target Audience: New customers.

- Follow-up: What made you decide to look into it further?

- How long did you research before buying [Product]?

- Purpose: Understand buying cycle length.

- Target Audience: Recent buyers.

- Follow-up: What information helped you make your decision?

- Which alternative products did you compare before purchasing?

- Purpose: Identify your closest competitors.

- Target Audience: New customers.

- Follow-up: What tipped the decision in our favor?

- What almost stopped you from buying [Product]?

- Purpose: Find barriers to purchase.

- Target Audience: Recent buyers.

- Follow-up: What could we have done to address that concern earlier?

Product Improvement and Innovation Questions

- If you could add one feature to [Product], what would it be?

- Purpose: Gather ideas for future development.

- Target Audience: All customers.

- Follow-up: How would this feature make a difference for you?

- What’s the most frustrating part of using [Product]?

- Purpose: Identify pain points.

- Target Audience: Active users.

- Follow-up: What would make this frustration go away?

- If you could change one thing about [Product], what would it be?

- Purpose: Find improvement opportunities.

- Target Audience: All customer types.

- Follow-up: Why would that change matter most to you?

- What’s a feature you wish [Product] had that competitors offer?

- Purpose: Close competitive gaps.

- Target Audience: Customers aware of competitor products.

- Follow-up: How important is this feature to you?

- What’s something you love about a competitor’s product that we don’t offer?

- Purpose: Uncover differentiator opportunities.

- Target Audience: Switchers or multi-product users.

- Follow-up: Would having this feature keep you from switching?

Pricing Perception Questions

- Do you feel [Product] is fairly priced?

- Purpose: Measure perceived value.

- Target Audience: All customers.

- Follow-up: Why or why not?

- If we increased the price by 10%, how would that affect your decision to buy?

- Purpose: Test pricing elasticity.

- Target Audience: All customers.

- Follow-up: What price point feels fair for the value you get?

- Would you be interested in a lower-priced plan with fewer features?

- Purpose: Explore potential for tiered pricing.

- Target Audience: Price-sensitive customers.

- Follow-up: Which features would you be willing to give up?

- How does our price compare to similar products you’ve tried?

- Purpose: Benchmark pricing.

- Target Audience: Customers with competitor experience.

- Follow-up: What makes our product worth more or less?

- Would you pay more for premium support or added features?

- Purpose: Test upsell potential.

- Target Audience: Heavy users or high-value accounts.

- Follow-up: Which added benefits would make it worth the price?

Customer Support and Experience Questions

- How satisfied are you with your most recent interaction with our support team?

- Purpose: Measure support quality.

- Target Audience: Customers who’ve contacted support.

- Follow-up: What could we have done better?

- Was your issue resolved in a timely manner?

- Purpose: Gauge resolution speed.

- Target Audience: Recent support cases.

- Follow-up: If not, what caused the delay?

- How easy was it to get in touch with support?

- Purpose: Assess accessibility.

- Target Audience: Support users.

- Follow-up: Which communication channel do you prefer?

- Did the support agent explain the solution clearly?

- Purpose: Evaluate communication effectiveness.

- Target Audience: Support users.

- Follow-up: What could have made it clearer?

- Overall, how would you rate your experience with [Company Name] after receiving support?

- Purpose: Link support experience to product satisfaction.

- Target Audience: Customers after a support case closes.

- Follow-up: What’s the main reason for your rating?

Timing and Frequency: When to Send Product Surveys for Best Results

The timing of your product surveys can make or break the quality of your feedback.

Surveys sent at the right moment in the customer lifecycle, such as after a purchase, following the use of a specific feature, or immediately after a support interaction, are more likely to yield relevant and actionable responses.

Event-based surveys work well because the experience is still fresh in the customer’s mind.

You can also choose between ongoing feedback programs, which capture long-term sentiment trends, and one-off campaigns, which provide quick snapshots of customer opinion.

With Polling.com’s scheduling and automation tools, you can set surveys to trigger at precisely the right time, ensuring maximum engagement with minimal manual effort.

How to Increase Response Rates for Product Surveys

Getting customers to open and complete your product feedback survey is half the battle.

By combining personalization, smart incentives, and thoughtful survey design, you can significantly boost participation rates without sacrificing feedback quality.

Personalization Strategies For Product Survey Questions

Generic customer opinion surveys are easy to ignore, but personalized ones stand out.

Including the customer’s name, referencing their recent purchases, or mentioning the exact product they’ve used makes the interaction feel more relevant and human.

This small touch increases the likelihood that recipients will complete the survey and provide thoughtful feedback.

Incentives That Actually Work

While many companies offer incentives for paid surveys, not all rewards are equally effective.

Discounts on future purchases, early access to new features, and loyalty points often perform well because they provide direct value to the customer.

The key is to offer something meaningful without overshadowing the primary goal, which is to get honest feedback.

Reducing Survey Fatigue

If your customers feel like they’re constantly being asked for feedback, they’re likely to disengage. So, keeping surveys short and to the point helps prevent this.

Aim to collect the essential data without overwhelming respondents, ensuring you maintain data quality while respecting their time.

Analyzing and Acting on Product Survey Results

Collecting survey responses is only the first step, as real value comes from what you do with the data.

By knowing how to interpret results, avoid common product analysis traps, and present findings clearly, you can turn raw product usability feedback into actionable changes that improve your product and customer satisfaction.

Turning Raw Data into Actionable Insights

Numbers and comments alone won’t improve your product; you need to translate them into clear actions.

Identify recurring themes, link them to your business goals, and prioritize the changes that will have the greatest impact on user experience.

Common Pitfalls in Product Survey Interpretation

Data can be misleading if taken out of context.

So, avoid overgeneralizing from a small sample size, confusing correlation with causation, or ignoring outlier responses that might signal emerging trends.

Using Polling.com’s Analytics Dashboard vs. Manual Analysis

Polling.com offers built-in analytics tools that can save you hours of manual work, from generating trend graphs to filtering responses by segment.

However, manual deep-dives may still be valuable for nuanced or qualitative feedback.

Creating Visual Reports for Stakeholders

Not all stakeholders want to read a 20-page analysis.

That’s why you need to transform your findings into easy-to-digest visuals, like charts, heat maps, or key takeaway slides to highlight the most important results and recommendations.

Common Mistakes to Avoid in Product Survey Questions

Even the most well-intentioned product surveys can miss the mark if the questions are poorly designed.

Common missteps include overloading respondents with too many questions at once, which can lead to survey fatigue and higher drop-off rates.

Using jargon or overly complex language can also confuse participants, resulting in unclear or inaccurate responses.

Irrelevant questions that don’t directly relate to your product or user experience waste valuable time and dilute the quality of the data you collect.

Finally, one of the biggest mistakes is gathering feedback and then doing nothing with it.

Customers want to know their opinions matter, so failing to act on or communicate the results can damage trust and reduce future participation.

How Product Survey Questions Fit Into Your Larger Feedback Strategy

Product survey questions shouldn’t live in isolation. They’re most powerful when connected to your broader customer feedback framework.

Tying surveys to established metrics like NPS, CSAT, and CES allows you to benchmark sentiment while still capturing nuanced, open-ended responses that reveal the “why” behind the scores.

By integrating these surveys directly into your CRM or product analytics platforms, you can combine customer feedback with behavioral data to spot patterns, identify friction points, and prioritize improvements that will have the biggest impact.

The insights gathered can then feed into a continuous feedback loop where customer voices guide development roadmaps, validate feature launches, and inspire innovative solutions.

Over time, this tight alignment between surveys and your overall feedback ecosystem ensures your product evolves in lockstep with user needs.

The Compounding Value of Asking the Right Questions

Every carefully crafted product survey question is an investment in clarity, alignment, and growth.

When you ask the right product survey questions consistently and act on the answers, you create a compounding effect: insights become improvements, improvements build loyalty, and loyalty drives sustainable success.

This cycle doesn’t just help you make better products; it transforms the way customers see and trust your brand. Instead of guessing what your users want, you’ll have a living, breathing stream of feedback shaping every decision.

Start building that momentum today with Polling.com, and create custom product surveys designed to turn customer opinions into your competitive advantage.