Market Demand Survey: Understand What Customers Really Want

Before launching any new product, one question matters most: is there real demand for it?

Many startups and businesses skip this crucial step and end up with great ideas that simply don’t sell. Testing market demand early helps you avoid wasted time, effort, and investment.

Surveys are one of the most cost-effective, data-driven methods to validate your product ideas and perform early product market validation.

They give you direct insights from real people — your potential customers — about their needs, expectations, and willingness to buy.

But the quality of your insights depends entirely on the questions you ask.

Crafting thoughtful, well-structured market demand survey questions is the key to turning raw feedback into actionable direction for your business.

Why Conduct a Market Demand Survey Before a Product Launch?

A market demand survey gives you clarity before you commit. It helps you understand what people actually want, not what you think they want.

Here’s why it’s worth doing:

- Reduce the risk of failure: Launching without research is like shooting in the dark. A demand survey shows whether there’s real interest in your idea before you invest in production, marketing, or logistics.

- Understand your target audience: By analyzing survey data, you’ll discover who your ideal customers are, what problems they face, and what solutions they value most.

- Refine your product and pricing: Use feedback to fine-tune your product features, adjust pricing, or reposition your offering for stronger market fit.

- Save time and money: Tools like Polling.com make it easy to create and distribute professional surveys quickly. With built-in analytics and customizable templates, you can get meaningful insights in days instead of weeks.

In short, conducting a market demand survey before launch ensures you’re building something people actually want, and that’s the foundation of any successful product.

Crafting Effective Market Demand Survey Questions

Creating a great survey isn’t just about asking questions; it’s about asking the right ones.

Well-designed questions help you uncover what truly drives customer decisions and translate opinions into data you can act on through a well-structured consumer interest survey.

Before you start, clarify what you want to learn, then choose types of survey questions that align with your goals.

Start With Clear Survey Goals

Every product researcher or marketer should begin by defining the purpose of their survey.

Are you testing product appeal, feature relevance, or price sensitivity?

Having a clear goal keeps your survey focused and ensures every response contributes to a specific business decision.

Examples of goal-aligned questions:

- Testing appeal: How interested are you in a product that helps you [specific benefit]?

- Testing pricing: At which price point would you consider this product to be too expensive?

- Testing feature relevance: Which of these features would be most useful to you?

- Testing demand: How likely are you to buy this product within the next three months?

Setting clear goals helps you collect survey data that supports exploratory research marketing, giving you clarity before making big decisions.

Key Question Types to Include

Here are a few key question types to include in your survey.

Awareness Questions

- Example: Have you experienced [problem your product solves]?

- These identify whether customers even recognize the problem your product addresses.

Interest Questions

- Example: How likely are you to try a product that [specific benefit]?

- Use these to measure curiosity and engagement with your idea.

Purchase Intent Questions

- Example: Would you buy a product like this at $X?

- These reveal if interest translates into actual buying intent, which is a key factor for your market demand curve.

Price Sensitivity Questions

- Example: What price range would you consider acceptable for this type of product?

- Perfect for determining perceived value and price tolerance.

Competitor Insight Questions

- Example: What tools or products do you currently use for [problem]?

- These highlight where your product can outperform existing solutions.

Together, these question types form a well-rounded product survey that captures awareness, interest, intent, and market context.

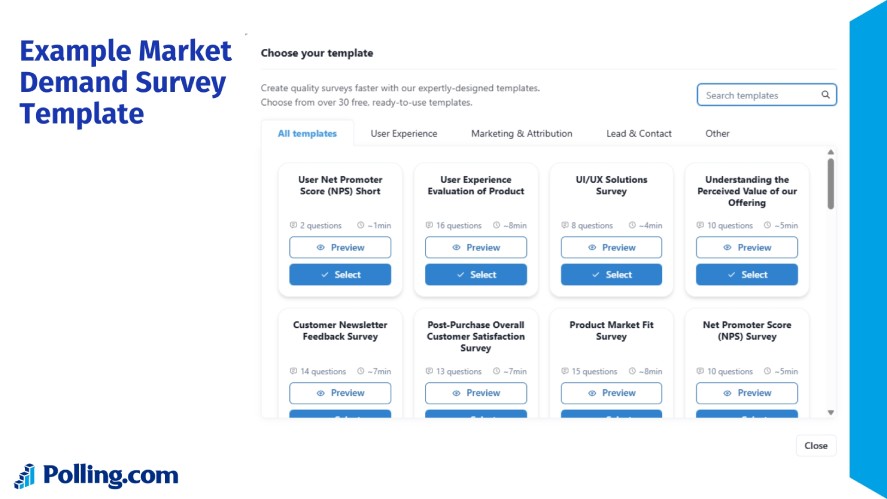

Example Market Demand Survey Template

Here’s a simple market product analysis example you can use as a starting point:

Example Template:

- Have you ever faced [problem your product solves]?

- How often does this issue affect you?

- How likely are you to try a product that [benefit]?

- What features would be most valuable to you?

- What price range would you consider reasonable?

- Which brands or tools do you currently use for this need?

- How likely are you to recommend such a product to others?

Platforms like Polling.com make this even easier, offering customizable templates, skip logic, and built-in analytics that automatically interpret your survey analysis results.

Whether you’re doing paid surveys or internal testing, these tools help you move from good survey questions to insights faster than ever.

How to Distribute Your Market Demand Survey Effectively

Even the best survey questions won’t deliver results if they don’t reach the right people.

Distribution is where your research turns from theory into valuable, actionable data driven by accurate target audience feedback.

Target the Right Audience

Start by identifying who your ideal respondents are — the people most likely to buy or benefit from your product.

Once you know that, focus your efforts where they’re already active:

- Email lists: Send surveys directly to subscribers or existing customers to get feedback from people already familiar with your brand.

- Social media: Platforms like Facebook, Instagram, and LinkedIn allow you to reach specific demographics based on interests, behaviors, and locations.

- Customer databases: If your company already has CRM data, use it to target segmented customer groups for more relevant insights.

- Lookalike audiences: Use paid ads to reach new users who share traits with your best customers, ideal for exploratory research marketing or testing new markets.

The key is balance: mix organic channels with paid targeting to ensure your survey reaches both loyal customers and untapped prospects.

Top Survey Apps to Use

Choosing the right survey platform is just as important as finding the right audience.

You need a tool that’s simple to set up, flexible for customization, and powerful enough to deliver detailed analytics.

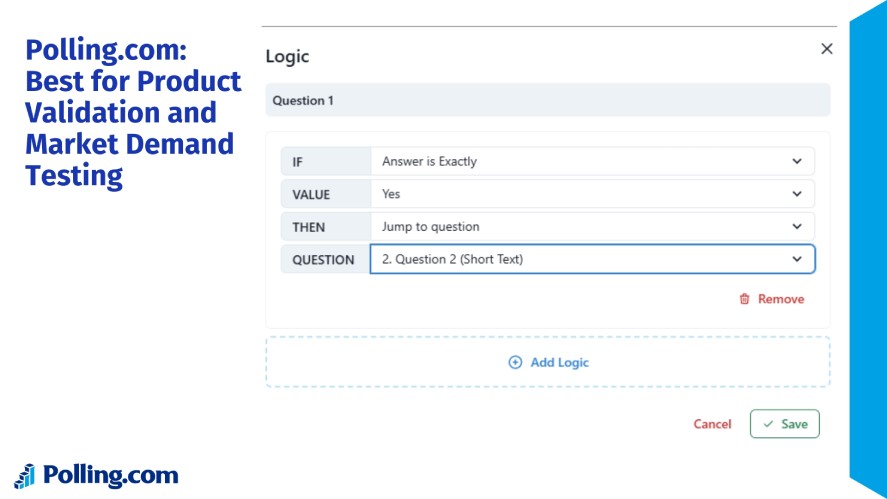

Polling.com: Best for Product Validation and Market Demand Testing

Polling.com offers advanced targeting options, built-in analytics, and pre-made templates designed specifically for product research.

Our smart survey logic adapts questions based on previous answers, keeping participants engaged while ensuring cleaner data.

Plus, the platform’s sleek interface makes the experience fast and intuitive, both for creators and respondents.

Google Forms: Best for Simple and Free Surveys

Google Forms is an easy-to-use option for quick surveys. It’s ideal for small-scale projects or internal feedback collection but lacks advanced targeting and analytics.

Typeform: Best for User Experience

Typeform’s conversational design and smooth UX encourage higher completion rates. Great for engaging respondents, though pricing can rise quickly for larger projects.

SurveyMonkey: Best for Enterprise-level Insights

A reliable platform with detailed reporting tools and branching logic, suitable for large organizations or academic research.

While all these tools work, Polling.com stands out for speed, user experience, and survey logic tailored to product validation.

It bridges the gap between DIY forms and professional market research, giving startups and small teams access to insights that once required full research departments.

Analyzing Your Market Demand Survey Results

Once your survey responses start rolling in, it’s time to turn that raw survey data into actionable insights.

Proper analysis helps you understand whether your product idea is worth pursuing, and what adjustments could make it more appealing to your audience.

Interpreting Likert Scale Responses

Likert scale questions (like “Strongly agree” to “Strongly disagree”) are ideal for measuring opinions and interest levels.

Look for strong clusters of agreement or disagreement, as they reveal how confident respondents feel about your product concept, features, or pricing.

For instance, if 80% of participants agree that your product solves a key problem, that’s a clear signal of demand.

Spotting Patterns in Product Interest or Pricing Feedback

Compare responses across different demographics or audience segments to spot trends.

Are younger users more interested in your product than older ones? Does one region show higher willingness to pay?

Patterns like these help you refine your positioning and pricing strategy to match real demand.

Making Go/No-Go Decisions Based on Data

Once you’ve analyzed your survey analysis results, use the findings to guide your next step:

- Go: If strong interest and purchase intent are present, move forward with confidence.

- Refine: If interest exists but pricing or features need tweaking, iterate before launch.

- No-Go: If feedback shows low demand or unclear need, reconsider your direction, as it’s better to pivot early than launch a flop.

Tools like Polling.com simplify this stage with built-in analytics that automatically visualize trends, averages, and correlations, helping you make smarter, data-backed decisions faster.

Common Mistakes to Avoid in Market Demand Surveys

Even small survey errors can lead to misleading conclusions. Avoid these common pitfalls to ensure your data stays accurate and useful:

- Asking leading questions: Don’t phrase questions in a way that pushes respondents toward a specific answer. Keep wording neutral.

- Including too many open-ended questions: While valuable, open-ended responses take longer to analyze and can reduce completion rates. Use them sparingly.

- Not segmenting your audience: Combine survey data with demographic or behavioral filters to understand which groups show the strongest demand.

- Ignoring negative feedback: Negative responses are gold, as they show what’s holding customers back and where your product needs improvement.

A clean, focused survey ensures every answer contributes meaningfully to your market analysis example.

Launch Smarter With the Right Survey Strategy

Launching a product without validating demand is a costly gamble.

A well-planned market demand survey gives you the insights you need to refine your idea, price it right, and position it effectively.

With the right questions to ask for surveys, distribution channels, and tools, you can turn uncertainty into confidence.

Whether you’re an entrepreneur testing a new idea or a product researcher optimizing your next launch, tools like Polling.com make the process seamless, from creating surveys to analyzing data in one place.

Start your market demand survey today with Polling.com – free to try!