Product Feedback Surveys: How to Collect and Act on Customer Insights

A product feedback survey is your ticket to understanding what customers really think about your product, offering a direct line to their needs, gripes, and wishes.

In today’s fast-moving world, where product development and customer retention are make-or-break, these surveys are essential for staying ahead. By tapping into customer insights, businesses can fine-tune offerings, boost satisfaction, and keep users coming back.

This article dives into what makes a product feedback survey work, why it’s a game-changer for businesses, and how to run one effectively using customer feedback tools.

What Are Product Feedback Surveys?

A product feedback survey is a structured set of questions designed to gather customer opinions about a product’s features, performance, or overall experience. It helps businesses shape better offerings.

The purpose?

To uncover what users love, what frustrates them, or what they want next, fueling smarter decisions in product development.

Common question types include multiple-choice (Which feature do you use most?), Likert scale (Rate ease of use from 1-5), and open-ended (What could we improve?), each tailored to dig out specific consumer insights.

You’d use a product feedback survey at key moments: post-launch to gauge initial reactions, during beta testing to solve problems, or after customer churn to figure out why users left.

With product feedback software like Polling.com, crafting these surveys is quick, letting you collect actionable data from respondents with ease.

Why Product Feedback Surveys Matter for Businesses

Running a product feedback survey isn’t just checking a box, it’s a strategic move that drives growth. Here’s why it’s non-negotiable for any business serious about its customers.

Understanding Customer Needs and Expectations

A product feedback survey cuts through assumptions, letting you hear straight from respondents what they need and expect.

Let’s say you’re selling a fitness app, and questions like “What workout feature matters most?” reveal if users crave yoga flows or HIIT timers, guiding your next update.

This clarity, powered by customer feedback platforms, ensures you’re building what people actually want, not what you guess they do.

It’s a cornerstone of market research tools, helping you align with customer priorities and avoid costly missteps.

Driving Product Improvements Based on Real Data

Nothing beats real data for sparking product improvements, and a product improvement feedback survey delivers it in spades.

For example, if 70% of respondents flag a clunky checkout process in an e-commerce survey, you’ve got a clear target to fix.

Feedback tools like those from survey providers turn these insights into actionable steps, making your product sharper.

This data-driven approach, rooted in examples of market research, ensures upgrades are based on what users experience, not just internal brainstorming.

Enhancing Customer Loyalty Through Listening and Action

When you ask for feedback and act on it, customers notice, and that builds loyalty.

A product feedback survey shows respondents you’re listening, like when a coffee shop chain adds oat milk after survey requests spike.

Following through with changes, tracked via customer feedback management tools, turns one-time buyers into repeat fans. It’s a loyalty loop: ask, improve, retain.

By using marketing survey tools to close the feedback gap, you boost customer satisfaction and keep users invested in your brand’s journey.

Best Practices for Creating Effective Product Feedback Surveys

Crafting a product feedback survey that delivers actionable insights requires some know-how. Here’s how to make yours count with respondents and drive real results.

Setting Clear Goals for the Survey

Before you write a single question, nail down what you want from your product feedback survey. Are you testing a new feature’s appeal, like a redesigned app dashboard, or digging into why sales dropped?

Clear goals shape everything, from questions to audience, and even timing.

For instance, a goal like “understand barriers to checkout” leads to targeted prompts like “What stopped you from completing your purchase?”.

Using product survey tools, you can align your survey with these objectives, ensuring every response ties back to your aim, making it a key step in examples of market research done right.

Choosing the Right Questions and Format

The heart of a product feedback survey is its questions. So, pick the ones that hit your goals without overwhelming respondents.

Multiple-choice questions, like “Which feature do you use daily?” are quick to answer, while Likert scales like “Rate this from 1-5” quantify satisfaction.

Open-ended questions, like “What’s one thing we could improve?” uncover surprises but use them sparingly to avoid survey fatigue.

Formats matter too! Try to keep surveys short, ideally 5-7 questions, and mobile-friendly.

Customer feedback platforms like Polling.com offer templates to mix these formats smartly, maximizing insights while keeping respondents engaged.

Timing and Frequency: When to Send Product Feedback Surveys

Timing your product feedback survey can make or break response rates. So, send it when customers are most likely to care.

Post-purchase is great for e-commerce (How was your checkout experience?), while post-update works for software (What do you think of the new layout?).

Avoid spamming and striking a balance for quarterly or post-interaction surveys. For example, a SaaS company might survey users two weeks after a feature launch to catch fresh feedback.

Feedback software helps schedule these strategically, ensuring you hit respondents at the right moment without overdoing it.

Analyzing and Acting on the Feedback

Collecting responses is just the start, analyzing and acting on them is where a product feedback survey shines.

Sort quantitative data (65% rate usability 4/5) for trends and qualitative answers (App crashes often) for pain points.

Prioritize fixes based on impact, like patching bugs if 80% complain, then communicate changes to users with a message like “We fixed the crash, thanks to your feedback!”.

Customer feedback tools with analytics, like those from customer survey companies, make this easier by visualizing trends and tracking action plans, turning raw data into product wins.

Top Tools for Conducting Product Feedback Surveys in 2026

Running a product feedback survey is smoother with the right tools. Here’s why Polling.com leads the pack, plus a quick look at other options.

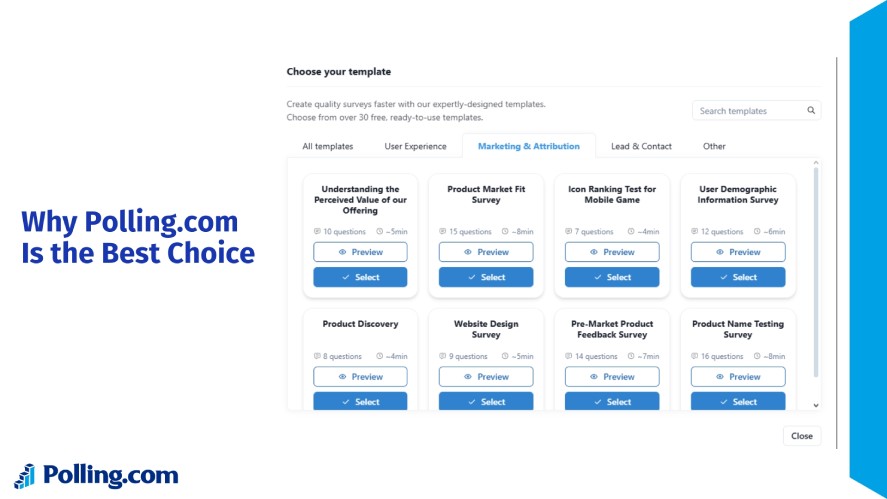

Why Polling.com Is the Best Choice

Polling.com stands out as a top customer feedback platform for its ease of use, customizable templates, and advanced analytics, making it a go-to among product feedback tools.

You can create a product feedback survey in minutes with drag-and-drop templates tailored for launches or beta tests, no coding needed. Its analytics dive deep, helping you spot what’s working or not.

Compared to others, Polling.com’s edge is its seamless integration of feedback loops, letting you act fast.

Against SurveyMonkey (robust but pricier), Typeform (flashy but less analytical), and Google Forms (free but basic), Polling.com balances power and simplicity. It’s ideal for businesses eyeing the best market research tools.

Other Noteworthy Tools

Beyond Polling.com, a few other product survey tools deserve a nod.

- Survicate offers strong in-app survey options, which are great for SaaS companies collecting real-time user feedback, though it’s less versatile for broader market research.

- Qualtrics, a heavyweight among customer satisfaction survey companies, excels in complex analytics but can feel overwhelming for small teams.

- HubSpot’s feedback module integrates well with its CRM, perfect for marketing survey tools but tied to its ecosystem.

These options, while solid, don’t match Polling.com’s all-in-one ease for most product feedback survey needs.

Real-World Examples of Product Feedback Surveys in Action

Seeing a product feedback survey in action shows its power. Here are two cases where businesses turned customer insights into wins.

Case Study 1: SaaS Company Improving UI from User Feedback

A SaaS company launching a project management tool used a product feedback survey to refine its user interface.

Post-beta, they sent a survey via Polling.com asking respondents the following questions:

- How intuitive is the dashboard? (1-5)

- What’s one UI feature you’d change?

Of 1,000 users, 60% rated intuitiveness 3/5 or lower, and open-ended responses flagged a cluttered layout.

Acting on this, the team streamlined the dashboard, cutting unused widgets. A follow-up survey showed 85% now rated it 4/5 or higher, boosting user retention by 15%.

This example of market research, powered by a user feedback platform, turned an average UI into a standout feature.

Case Study 2: eCommerce Brand Adjusting Product Line Based on Survey Data

An eCommerce brand selling eco-friendly home goods ran a product feedback survey to understand slow sales in their kitchen line.

Using a customer feedback management tool, they asked 2,000 recent buyers, “Which kitchen product do you use most?” and “Why did you skip certain items?”.

Results showed 70% preferred bamboo utensils but found the cutting boards too pricey. The brand then slashed board prices by 20% and added a budget-friendly line, leading to a 25% sales bump in three months.

This market research tool-driven survey proved how listening to respondents can reshape a product line for better traction.

Common Mistakes to Avoid When Using Product Feedback Surveys

Even the best product feedback survey can flop if you stumble into these traps. Here’s what to watch out for.

Asking Leading or Vague Questions

Questions that steer respondents, like “How much do you love our amazing app?” or vague ones like “What do you think?” can skew your data.

Leading questions push biased answers, while vague ones leave respondents confused, muddying insights.

Instead, ask neutral, clear questions like “How would you rate our app’s speed? (1-5)” to get honest, actionable feedback.

Product feedback software like Polling.com helps with pre-tested templates to keep your survey sharp and effective.

Ignoring Negative Feedback

It’s tempting to focus on glowing customer product reviews, but ignoring negative feedback is a missed chance to grow.

If 30% of respondents in a product feedback survey call your checkout slow, ignoring it risks losing customers. You should dig into criticism, use feedback tools to spot patterns, like frequent complaints about load times, and fix them.

Addressing pain points, a key part of user satisfaction surveys, shows respondents you’re serious about improving.

Failing to Follow Up with Respondents

Collecting feedback but ghosting respondents kills trust. If users take time to answer your product feedback survey, they expect action, or at least a nod.

Failing to follow up, like not sharing how you used their input, makes future surveys feel pointless. Instead, send a quick email, like “Thanks! We’re speeding up our app based on your feedback”, to close the loop.

Survey providers with automation, like Polling.com, make follow-ups easy, keeping respondents engaged for the long haul.

Conclusion

A product feedback survey is more than a data grab, it’s a direct line to what makes your customers tick, driving smarter product tweaks and deeper loyalty.

From uncovering needs to fixing pain points, these surveys are a must for any business aiming to stay competitive.

Whether you’re a SaaS startup or an eCommerce giant, the best market research tools, like Polling.com, make it easy to ask, analyze, and act.

Don’t wait! Start collecting customer insights today with Polling.com’s intuitive product feedback survey builder and watch your business level up.